Tesla (NASDAQ: TSLA) bull ARK Invest, headed by CEO and CIO Cathie Wood, loaded up on shares of the electric automaker’s stock as it has slid to lower prices over the past few weeks.

According to ARK’s Daily Trade Information, the fund bought 19,272 shares of Tesla, adding onto its massive holdings of the electric automaker’s shares. After the purchase on Friday, ARK now holds 3,566,628 shares of Tesla stock, which makes up 9.99% of its total portfolio. Square Inc. is ARK’s second-largest holding, with 6.28% of the portfolio being made up of the financial company.

ARK’s Tesla holdings are worth $2,132,665,212.60, according to the documents released on Friday.

The purchase of 19,272 additional shares supplements the addition of 130,000 shares in mid-February that were added to several different ARK ETFs. The ARK Innovation ETF bought 89,447 TSLA shares, while the ARK Next Generation Internet ETF added 29,508 Tesla stocks, and the ARK Autonomous Technology and Robotics ETF added 13,173 shares in February.

ARK is one of Tesla’s biggest bulls on Wall Street, holding tremendously high expectations for the electric automaker’s outlook over the next nine years. By 2030, ARK believes that Tesla’s Robotaxi fleet could generate more than $1 trillion in operating revenue, evidently remaining bullish on the automaker despite a recent slide in stock price.

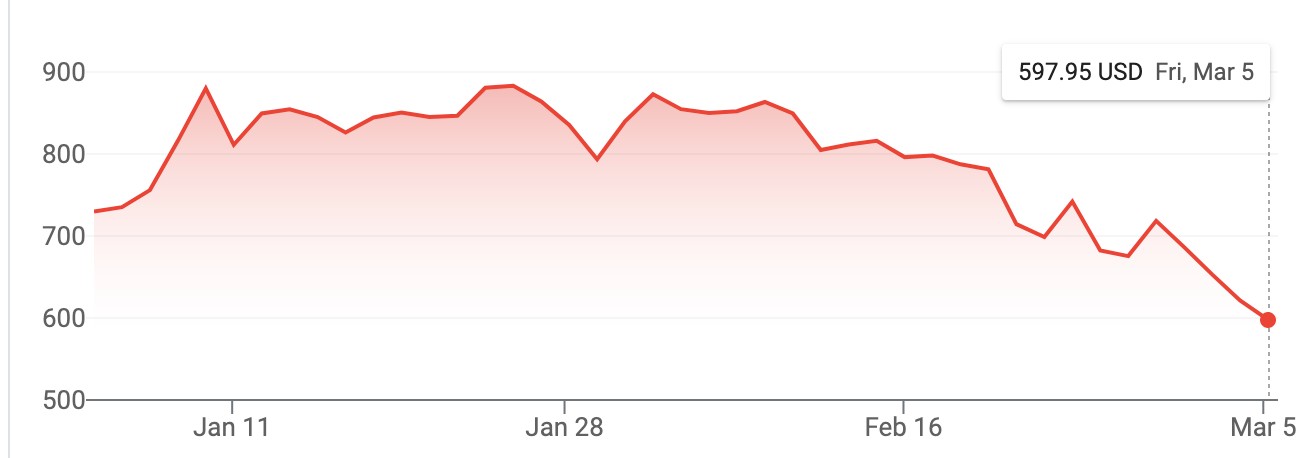

Tesla is down 30.75% over the past month and down 18% on the year. The stock currently sits at $597.95, closing on Friday down 3.78% or $23.49.

Tesla’s 2021 Stock Graph (Google)

After surging to prices as high as $880.02 in January, the stock remained relatively consistent in price until February 8th, when the price began to fall. Some analysts attributed the fall to Tesla’s lack of delivery forecast after the Q4 2020 Earnings Call. While Tesla executives didn’t give a specific figure, they did indicate that they expect 50% growth in deliveries annually, with some years providing more expansion.

A statement during the company’s most recent Earnings Call said that Tesla expects “to achieve 50% average annual growth in vehicle deliveries. In some years, we may grow faster, which we expect to be the case in 2021.” Additionally, it is difficult to give a specific figure as Tesla is expecting both Giga Berlin and Giga Texas to be completed at some point this year. With both facilities moving along quickly in the construction process, there is no specific time frame when they will be completed, which could be why Tesla did not provide specific delivery goals for 2021.

Many believe this is a temporary setback for Tesla. With expanding demand for the company’s vehicles and its place as the EV leader, Tesla is primed to dominate an expanding sector in the coming years. Dan Ives of Wedbush believes Tesla’s path to victory ultimately lies in China, where competitors are firing on all cylinders to catch up with Elon Musk’s company.

Tesla stock pullback temporary, China demand paves way to $1T market cap, Wedbush says

Disclosure: Joey Klender is a TSLA Shareholder.